If you’re looking for a hassle-free way to manage your finances, Jazz Cash has got you covered. By opening a Jazz Cash account, you can experience the convenience of swift and secure transactions, all at the click of a button. Say goodbye to lengthy paperwork and traditional banking methods, and hello to a simpler way to handle your money.

How to Make Jazz Cash Account

With a Jazz Cash account, you can easily send and receive payments, withdraw cash, and pay bills from the comfort of your own home or on-the-go. Plus, you can enjoy exclusive discounts and cashback offers when you shop with Jazz Cash partners.

To open your Jazz Cash account, all you need is your CNIC and mobile phone. Registering is quick, easy, and free.

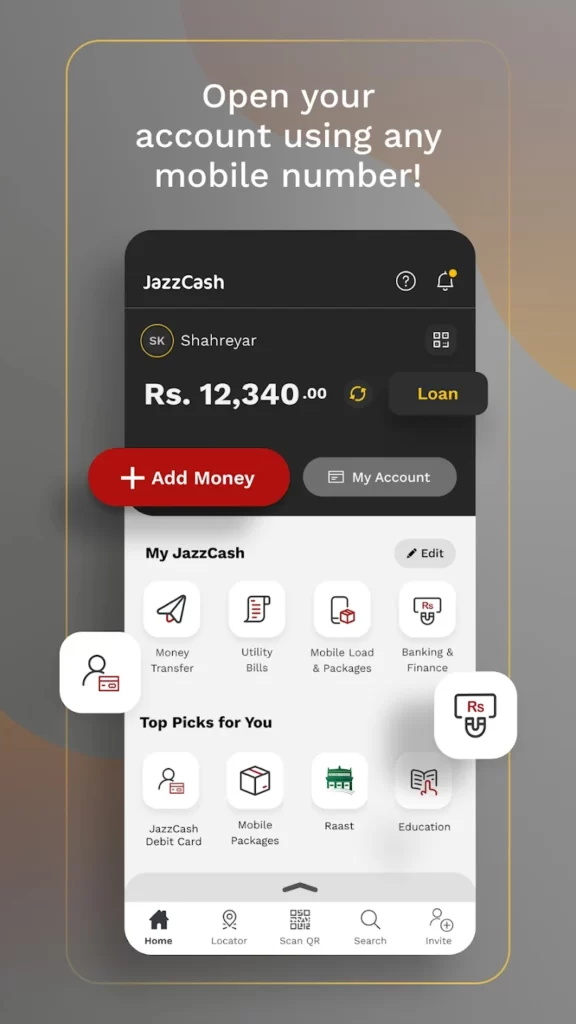

A sleek and modern smartphone displaying the Jazz Cash logo prominently. The phone is held by a hand that is swiping and tapping on the screen, showcasing the ease of using the app for transactions. The background is a vibrant green color, suggesting growth and prosperity.

Key Takeaways:

- Open a Jazz Cash account for a seamless banking experience.

- Enjoy swift and secure transactions with Jazz Cash.

- Use Jazz Cash for bill payments and cash withdrawals.

- Get exclusive discounts and cashback offers with Jazz Cash partners.

- Registering for a Jazz Cash account is quick, easy, and free.

Why Choose Jazz Cash for Your Banking Needs?

Are you looking for a convenient and reliable banking solution? Look no further than Jazz Cash! Our account features and benefits are tailored to your needs and designed to make your banking experience as seamless as possible. Here are just a few reasons why Jazz Cash stands out:

Features

| Feature | Description |

|---|---|

| Mobile App | Access your account anytime, anywhere with our easy-to-use mobile app. |

| Jazz Cash ATM Card | Withdraw cash from any ATM in Pakistan with your Jazz Cash ATM card. |

| Bill Payment | Pay your bills from the comfort of your home with our hassle-free bill payment feature. |

| International Remittance | Send and receive money from around the world with our international remittance service. |

Benefits

- No account opening or maintenance charges

- Instant account opening with no paperwork required

- 24/7 customer support available

- Convenient and secure transactions

- Competitive exchange rates for international remittance

Jazz Cash is committed to providing you with a seamless and convenient banking experience. Sign up for a Jazz Cash account today and enjoy the benefits of convenient banking.

How to Open a Jazz Cash Account

If you want to experience the convenience and ease of Jazz Cash’s banking solutions, opening a Jazz Cash account is the way to go. Here’s how you can register for a Jazz Cash account:

- Visit the Jazz Cash website or download the Jazz Cash app from the App Store or Google Play Store.

- Click on the “Register” button and select “New Registration”.

- Enter your mobile number, CNIC number, and other required information.

- Create a 4-digit MPIN to secure your account.

- Accept the terms and conditions and click “Submit”.

- You will receive a confirmation message, after which you can start using your Jazz Cash account.

It’s that simple! By following these easy steps, you can open a Jazz Cash account in no time and start enjoying all the benefits of convenient banking.

Remember, your Jazz Cash account is linked to your mobile number, so ensure that you provide accurate information to avoid any complications during registration.

Accessing Your Jazz Cash Account Online

Once you have opened your Jazz Cash account, you can easily access it online to manage your transactions from anywhere.

To log in to your Jazz Cash account online, follow these simple steps:

- Visit the Jazz Cash website at www.jazzcash.com.pk

- Click on the “Login” button located at the top right corner of the page

- Enter your Jazz Cash Mobile Account Number and MPIN

- Click on the “Login” button to access your account

Once you have logged in, you can easily check your account balance, view your transaction history, and transfer funds between accounts. You can also pay bills, purchase airtime, and much more.

Jazz Cash’s online banking platform is user-friendly and secure, ensuring that your personal and financial information remains protected at all times.

Checking Your Jazz Cash Account Balance

Staying on top of your finances is essential for effective money management. With a Jazz Cash account, checking your account balance is quick and easy, allowing you to monitor your transactions and avoid overspending.

To check your Jazz Cash account balance, simply login to your account online or through the Jazz Cash mobile app. Once logged in, you will be able to view your available balance, recent transactions, and much more.

It is crucial to check your account balance regularly to ensure that you have sufficient funds for your transactions, whether it is paying bills, sending money, or making purchases. By keeping track of your account balance, you can avoid overdraft fees and other unnecessary charges.

Understanding Jazz Cash Account Fees

When it comes to banking, one of the most important things to consider is the fees associated with your account. With a Jazz Cash account, you can enjoy a range of services and features tailored to your specific needs, but it’s important to also understand the fees that apply.

Please note: All fees listed are in Pakistani Rupees (PKR) and are subject to change without prior notice.

| Transaction Type | Fee |

|---|---|

| Account Opening | 0 |

| Account Maintenance | 0 |

| Deposit/Load Money | 0 |

| Withdraw Money | 0-600 |

| Money Transfer to Mobile Account | 0-200 |

| Money Transfer to CNIC | 0-400 |

| Bill Payment | 0-15 |

As you can see, many transaction types with Jazz Cash do not incur any fees, such as account opening, account maintenance, and depositing money into your account. However, there are fees associated with withdrawing money, transferring money to a mobile account or CNIC, and bill payments.

It’s important to note that the fees for withdrawing money, transferring money, and bill payments vary depending on the transaction amount. For example, withdrawing money from an ATM can cost anywhere from 0 to 600 PKR, depending on the amount you wish to withdraw. Similarly, transferring money to a mobile account or CNIC can cost between 0 and 400 PKR, and bill payments can cost up to 15 PKR.

To avoid any surprises and ensure you are fully aware of the fees, be sure to check the Jazz Cash website or mobile app for the most up-to-date fee schedule. If you have any questions or concerns about the fees associated with your Jazz Cash account, you can also reach out to customer support for assistance.

Security Measures for Your Jazz Cash Account

Ensuring the security of your Jazz Cash account is a top priority for us. That’s why we have implemented various account security measures to protect your personal and financial information from unauthorized access.

When you sign up for a Jazz Cash account, you will be asked to create a secure password and a four-digit MPIN. It is essential to keep them confidential and not to share them with anyone.

In addition to this, we use state-of-the-art encryption technology to safeguard your account information. Our system automatically times out after a certain period of inactivity, ensuring that your account is not left open and vulnerable to potential threats.

If you suspect any unusual activity on your account, please contact our customer support team immediately. We will assist you in resolving the issue and securing your account.

Protecting Your Account from Scammers

As an online bank, we are aware of the risks associated with online scams and the impact they can have on our customers. Our team works tirelessly to detect and prevent fraudulent activity and provide our customers with a secure banking experience.

If you receive any suspicious emails or messages asking for your account information, please do not respond and report it to us immediately. Remember that Jazz Cash will never ask you to provide your account details over the phone or email.

Staying Up-to-Date with Jazz Cash Account Security

To keep your Jazz Cash account secure, it is crucial to stay up-to-date with the latest security information and guidelines. We regularly update our security protocols and provide our customers with relevant security information through our website, emails, and customer support channels.

A strong and protective fortress with a digital lock, guarding a glowing blue orb representing the Jazz Cash account.

By working together, we can maintain the security and integrity of your Jazz Cash account and ensure that your financial transactions are safe and secure.

Jazz Cash Account Limits and Restrictions

When it comes to using your Jazz Cash account, there are certain limits and restrictions that you should be aware of. These are in place to ensure the security and protection of your account and its transactions.

Jazz Cash Account Limits

There are several limits that apply to your Jazz Cash account, including:

| Limit | Description |

|---|---|

| Transaction Limit | The maximum amount you can transfer or receive through your Jazz Cash account per transaction is PKR 50,000. |

| Monthly Limit | The maximum amount you can transfer or receive through your Jazz Cash account in a month is PKR 200,000. |

| Balance Limit | The maximum balance you can maintain in your Jazz Cash account is PKR 1,000,000. |

It’s important to keep these limits in mind when conducting transactions through your Jazz Cash account to avoid any inconvenience or rejection.

Jazz Cash Account Restrictions

In addition to the limits, there are also certain restrictions that apply to your Jazz Cash account. These include:

- International transactions are not allowed through Jazz Cash.

- You cannot use your Jazz Cash account for any illegal or fraudulent activities.

- Your Jazz Cash account cannot be used for commercial purposes.

It’s important to adhere to these restrictions to ensure the safety and legitimacy of your Jazz Cash account.

By understanding the limits and restrictions of your Jazz Cash account, you can use it to its full potential and enjoy the convenience and ease it offers for your financial transactions.

Jazz Cash Account Support and Customer Service

As a Jazz Cash account holder, you have access to a range of support and customer service options to help you with your banking needs. Whether you have a question about your account or need assistance with a transaction, Jazz Cash is committed to providing you with the help you need.

One convenient way to get in touch with Jazz Cash customer support is through the Jazz Cash helpline. Simply call 4444 from your Jazz or Warid number, or 03000-04444 from any other network to speak with a customer service representative. The helpline is available 24/7, so you can get the help you need at any time.

Another option is to visit one of the many Jazz Cash agents located across Pakistan. These agents can assist you with a range of transactions, including cash deposits and withdrawals, bill payments, and more. To find a Jazz Cash agent near you, simply visit the Jazz Cash website and click on “Agent Locator.”

SMS Alerts

Jazz Cash also offers SMS alerts to keep you informed about your account activity. With these alerts, you can receive updates on your account balance, transactions, and more. To sign up for SMS alerts, simply dial *1111# from your Jazz or Warid number and follow the instructions.

Jazz Cash FAQs

If you have a question about your Jazz Cash account, you may be able to find the answer on the Jazz Cash website. The site features an extensive FAQ section that covers a wide range of topics, including account registration, transactions, and security measures. To access the Jazz Cash FAQs, simply visit the Jazz Cash website and click on “Help & Support.”

With a range of customer support options available, Jazz Cash is dedicated to providing you with the assistance you need to make the most of your account. Whether you prefer to speak with a representative over the phone, visit an agent in person, or search for answers online, Jazz Cash is here to help.

Additional Services and Features of Jazz Cash

Aside from its primary banking services, Jazz Cash offers an array of additional features that enhance your financial dealings. These additional services are designed to make your life easier, providing you with added convenience and customized solutions to meet your needs. Let’s explore some of the features that Jazz Cash has to offer:

JazzCash Mobile Account

The JazzCash Mobile Account is a service that allows you to transfer money, pay bills, and purchase mobile load directly from your mobile phone. With this service, you can send and receive money from any JazzCash agent or bank account. The JazzCash Mobile Account is a safe and secure way to manage your finances, without ever having to leave your home.

JazzCash Visa Debit Card

The JazzCash Visa Debit Card is a convenient way to access your Jazz Cash account funds. With this card, you can withdraw cash, check your account balance, and perform other transactions at ATMs and POS machines nationwide. The JazzCash Visa Debit Card makes it easy and hassle-free to make transactions on the go.

JazzCash QR Payments

JazzCash QR Payments is a service that allows you to make payments by scanning a QR Code. This fast and secure payment method eliminates the need for cash, making transactions easier and more efficient. JazzCash QR Payments can be used to pay at merchants, online stores, and even to pay utility bills.

| Additional Services | Features |

|---|---|

| JazzCash Sahulat | Pay your utility bills, subscribe to magazines, and purchase movie tickets with ease using JazzCash Sahulat. |

| JazzCash Discounts | Get exclusive discounts and deals on various merchants and brands across Pakistan by using JazzCash. |

| JazzCash International Remittance | Send and receive money from abroad through JazzCash’s international remittance partners. |

These additional services and features make Jazz Cash a comprehensive solution for all your financial needs. Sign up for a Jazz Cash account today and start exploring the added benefits!

Create an image of a person making a payment through their phone using Jazz Cash, with various icons representing different features such as bill payments, e-commerce transactions, mobile top-ups, and international remittances in the background.

How a Jazz Cash Account Enhances Your Everyday Transactions

With a Jazz Cash account, you can enjoy the convenience of conducting your everyday transactions with ease. Whether you need to pay bills, transfer money to family and friends, or shop online, Jazz Cash has got you covered. There are several benefits to having a Jazz Cash account, including:

- 24/7 availability of services

- User-friendly mobile app for easy access

- Instant money transfers to any mobile number

- Convenient bill payments for utilities, internet, and more.

With Jazz Cash, you can say goodbye to long wait times and queues at the bank. You can now manage your finances from the comfort of your home or on the go, with just a few clicks on your phone. The Jazz Cash app is designed to be easy to use, even for those who are not tech-savvy. Additionally, the app is available in both English and Urdu, making it accessible to all Pakistanis.

Another advantage of having a Jazz Cash account is the ability to send and receive money instantly. You no longer have to worry about the inconvenience of carrying cash or the risk of losing it. With Jazz Cash, you can transfer money to any mobile number in Pakistan, even if the recipient does not have a Jazz Cash account. This feature makes it the ideal choice for sending money to family and friends in need.

Finally, Jazz Cash allows you to pay your bills easily, no matter where you are. You can use the Jazz Cash app to pay for your utilities, internet, and other bills without having to leave your home or office. This feature is especially useful during the COVID-19 pandemic, where social distancing is encouraged.

Jazz Cash: The Ultimate Solution for Convenient Transactions

If you’re looking for a hassle-free way to manage your finances, signing up for a Jazz Cash account is the answer. With its user-friendly app and convenient services, Jazz Cash can help you make your everyday transactions with ease. So why wait? Open your Jazz Cash account today and experience the convenience of modern banking.

Conclusion

Congratulations on taking the first step towards a more convenient and personalized banking experience with Jazz Cash account.

By signing up for a Jazz Cash account, you gain access to a range of features and benefits that make managing your finances a breeze.

Enjoy Easy Transactions

With a Jazz Cash account, you no longer have to worry about carrying cash or waiting in long queues at the bank. You can make transactions quickly and conveniently from your mobile phone or computer.

Personalized Financial Solutions

Jazz Cash offers tailor-made financial solutions to meet your unique banking needs. Whether you want to pay your bills or transfer money to your loved ones, Jazz Cash has got you covered.

Reliable and Secure

With Jazz Cash, you can rest assured that your personal and financial information is in safe hands. Jazz Cash utilizes advanced security measures to ensure that your transactions are secure and protected at all times.

So what are you waiting for? Sign up for a Jazz Cash account today and enjoy a hassle-free banking experience like never before.

FAQ

Why should I choose Jazz Cash for my banking needs?

Jazz Cash offers a range of features and benefits that make it the perfect choice for your banking needs. With convenient banking solutions tailored to your requirements, managing your finances has never been easier.

How do I open a Jazz Cash account?

Opening a Jazz Cash account is quick and easy. Simply follow our step-by-step instructions for registration and start enjoying the benefits of a Jazz Cash account today.

How can I access my Jazz Cash account online?

With Jazz Cash, you can access your account online from the comfort of your home or wherever you are. Enjoy the convenience of online banking with Jazz Cash.

How do I check my Jazz Cash account balance?

Checking your Jazz Cash account balance is simple. We will show you how to easily monitor your account balance and stay on top of your finances.

What are the fees associated with a Jazz Cash account?

Understanding the fees involved with a Jazz Cash account is important. We provide an overview of the associated costs to help you make informed decisions regarding your financial transactions.

How does Jazz Cash ensure the security of my account?

At Jazz Cash, we prioritize the security of your personal and financial information. Our robust security measures are designed to keep your account safe and secure.

Are there any limits or restrictions on my Jazz Cash account?

There are certain limits and restrictions that apply to your Jazz Cash account. We outline these boundaries to help you effectively conduct your transactions within the set parameters.

What support and customer service options are available for Jazz Cash account holders?

Jazz Cash provides comprehensive support and customer service options for account holders. Find out how to reach out for assistance whenever you need it.

What additional services and features does Jazz Cash offer?

Jazz Cash goes beyond traditional banking services, offering a range of additional features to enhance your banking experience. Discover the added benefits that Jazz Cash brings to the table.

How does having a Jazz Cash account enhance my everyday transactions?

Having a Jazz Cash account can significantly enhance your everyday transactions. Experience the convenience and ease that Jazz Cash brings to your financial dealings.